what is considered income for child support in colorado

An overview of how child support is determined in Colorado. 7031 Koll Center Pkwy Pleasanton CA 94566.

What Is Considered Income For Child Support In Colorado Colorado Divorce Attorneys

Your choice is how many of.

. File a consumer dispute directly with the company who issued your credit report. Code 1673 the maximum garnishment percentages are. Pursuant to 15 US.

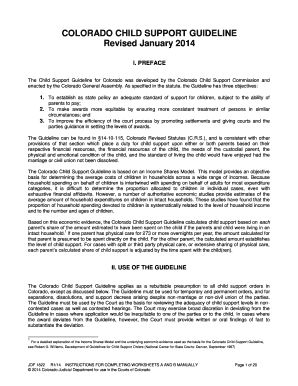

Contact the county child support caseworker handling your child support case. Calculation of the gross income of each parent gross income being income from any source other than child. To calculate a parents child.

Other customary expenses which the parents expressly include. What is not included is said to be an extraordinary expense. Under Colorado Revised Statutes Section 14-10-115 a parents adjusted gross income refers to his or her gross income minus pre-existing child support and alimony.

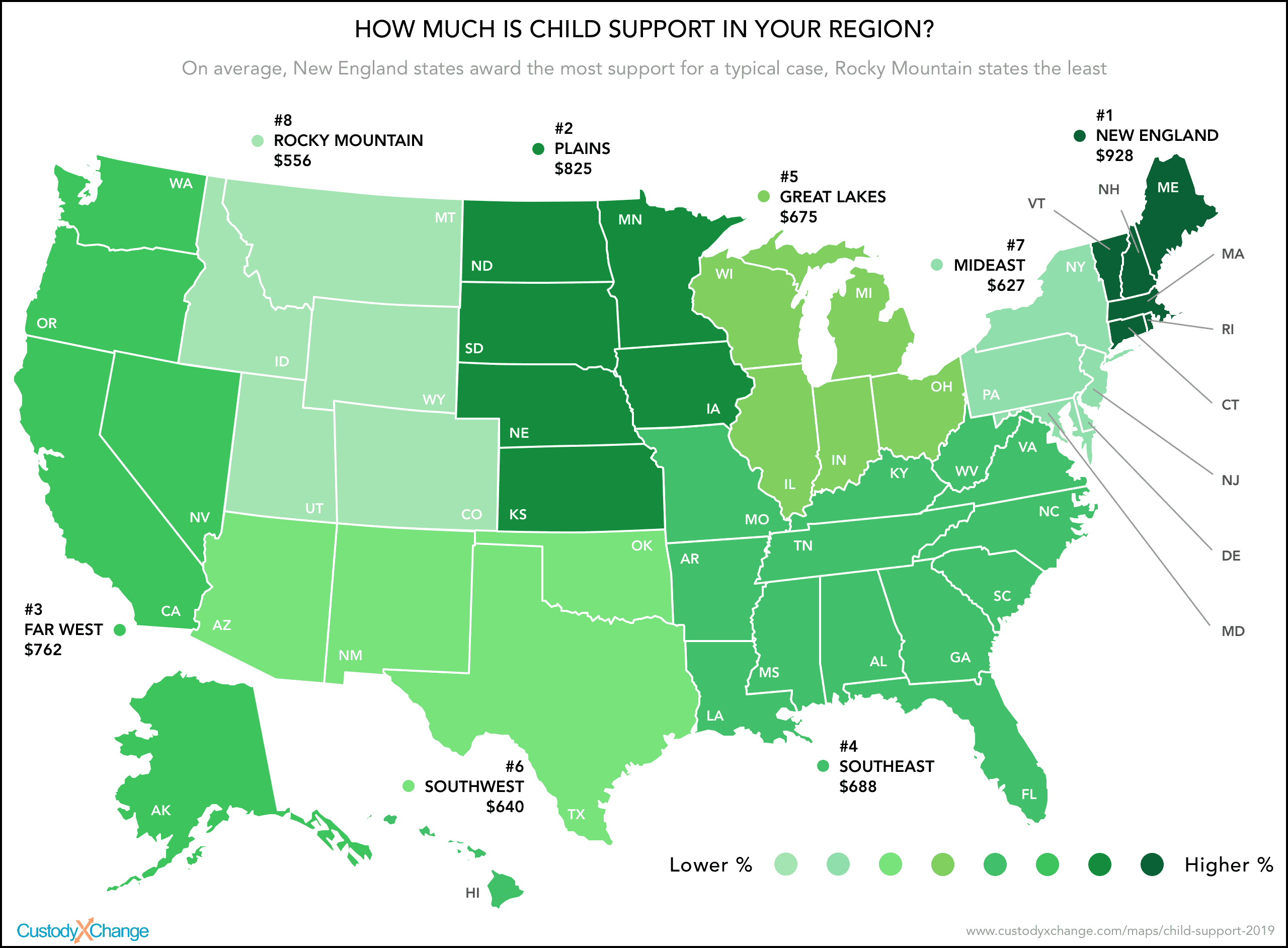

In Colorado child support is calculated by applying the child support guidelines The guidelines are in place to make support awards uniform and predictable. A child marriage is a marriage where one or both spouses. 50 of disposable earnings if the retiree is supporting another child or spouse or.

Only Revised October 2021. As a non-custodial parent the one who cares for the child. 1 - Basic Expenses.

In Colorado every child has the right to be financially supported by his or her parents whether the parents are married to one another or. You have three options. July 1 2021.

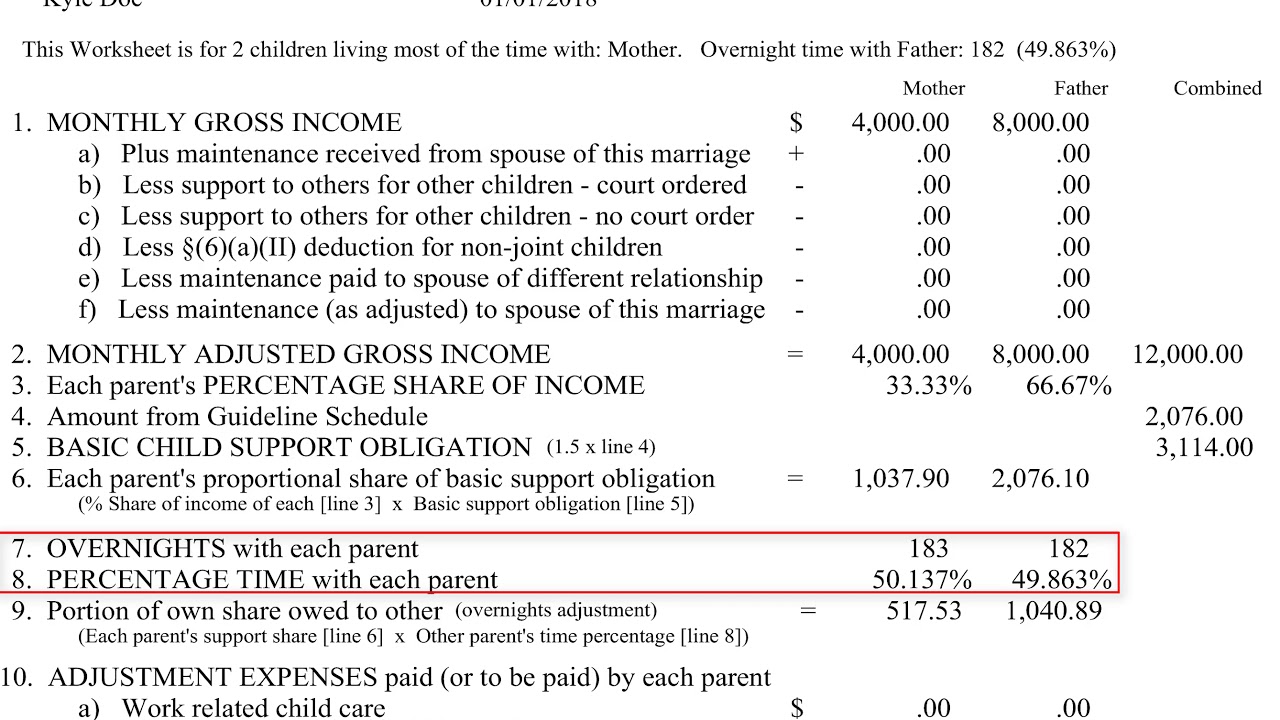

The non-custodial parents income is 666 of the parents total combined income. The starting point for determining the child support payments in Colorado is the pre-tax income of each parent. Child support payments in Colorado are calculated using the income shares method.

The court estimates that the cost of raising one child is 1000 a month. Depending on the circumstances it is possible for social security benefits retirement benefits loan proceeds and stock option sales proceeds to also be considered income in terms of child. The Colorado Supreme Court considered the question of whether an inheritance should be counted towards a parents gross income for the purpose of modifying child support.

Each parents gross income. Colorado Child Support Guidelines For cases on or after. Which moneys must be considered income from self -employment.

Colorados Schedule of Basic Child Support Obligations sets this amount. The Basics You Should Know About Child Support Calculations in Colorado. A larger combined income or.

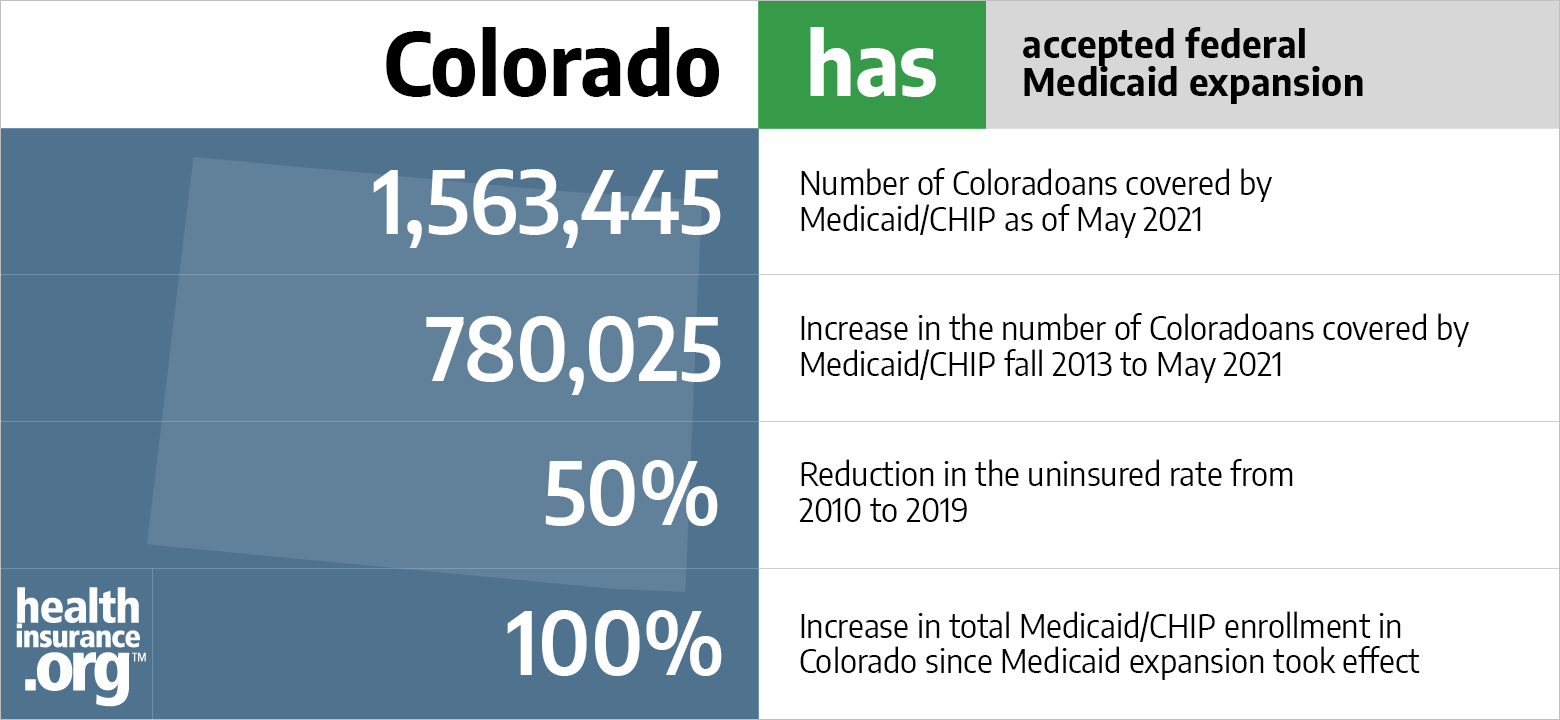

Aca Medicaid Expansion In Colorado Updated 2022 Guide Healthinsurance Org

What Is The Minimum Amount Of Child Support In Colorado Johnson Law Group

High Income Earners The Colorado Child Support Guidelines

Child Support And High Income Families Plog Stein P C

Child Support Basic Obligation Colorado Family Law Guide

Changes To Colorado Child Support Law Denver Family Law Attorney

Colorado Child Support Worksheet Fill Out And Sign Printable Pdf Template Signnow

Fort Collins Child Support Lawyer Levi A Brooks Attorney At Law P C

Child Support An Essential Guide 2022

Coloraedo Child Support Worksheet B Fill Out Sign Online Dochub

2020 Colorado Child Support Changes Updated Griffiths Law

Colorado Child Support Worksheets Youtube

Colorado Child Support Calculator 2022 Simple Timtab

How To Calculate Anticipated Alimony And Child Support

Social Security Alimony Child Support Colorado Family Law Guide

Child Support 101 Child Support Calculation In Colorado

Parents Can Legally Cheat Children Out Of Support

Is Your Spouse Shirking Their Support Obligation Coloradobiz Magazine