summit county utah sales tax

Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06. Complete the online building application.

Park City Reminds Me A Little Of The Former Bingham Canyon Now Gone

County County Public Transit.

. Access Utah sales and use tax rates on the Utah State Tax Commissions website. The Summit County 2021 Tax Sale will be held on. Delinquent taxes for a specific.

Certain types of Tax Records are available to the general. Summit County Utah Recorder-4353363238 Assessor-4353363211. Summit County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Summit County Utah.

Bids Request for Proposals. The 2018 United States Supreme Court decision in South Dakota v. You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables.

6 rows The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and. Lowest sales tax 61 Highest sales tax. These records can include Summit County property tax assessments and assessment challenges appraisals and income taxes.

2022 List of Utah Local Sales Tax Rates. The Assessors Office is responsible for the appraisal of real property homes condos recreational parcels vacant land commercial and industrial properties. State Local Option Mass Transit Rural Hospital Arts Zoo Highway County Option Town Option and Resort taxes.

Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Pre-addressed to Summit County Treasurer Lockbox co Alpine Bank PO Box 3918 Grand Junction CO 81502.

The amount sold at the tax lien sale includes the unpaid taxes the county interest of 1 per month and the advertising fee. A county-wide sales tax rate of 155 is. Summit County Home Page.

Automating sales tax compliance can help your business keep compliant with. March 4 2021 by Kerry Halligan. Access county bids and request for proposals.

Municipal Advisor One South Main Street 18th Floor Salt Lake City UT 84133. County Jan-18 11917001 24238463 3737024 75292525 13963108 55689080 30979593. The Utah state sales tax rate is currently.

Sales tax rates for Summit County pdf County sales tax history pdf Mass transit sales tax history pdf To get more information on town sales tax please contact. Manage Summit County Funds. The amount to redeem is the amount sold at the tax lien sale plus the investors interest based on a per month basis.

Beer Alcohol Licensing. The Summit County sales tax rate is. The Summit County Treasurer is responsible for the collection distribution and reconciliation of property taxes levied by all of the taxing entities in Summit County.

The entire combined rate is due on all taxable transactions in that tax jurisdiction. Has impacted many state nexus laws and sales tax collection requirements. Summit County Utah Sales Tax Rev Bonds Series 2021.

The property owner is allowed to redeem the tax lien at any time. To review the rules in Utah visit our state-by-state guide. When using the envelopes included with your tax notice please make sure to include the coupons with your payment.

Payments by Mail or in Person To submit your property tax payment by mail make checks payable to Summit County Treasurer. The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend.

The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council. 3 rows Summit County UT Sales Tax Rate The current total local sales tax rate in Summit County. 8 rows The Summit County Sales Tax is 155.

Utah State Tax Commission Distribution of Sales and Use Taxes And Other Distributions Summit County CoCity 22000 Sum of Payment Tax Type Distrib Period Arts Zoo County Option E-911 Liquor Mass Transit Restaurant Sales Transient Room Addl Transit. The office also assesses and collects taxes on business personal property owned and leased mobile homes and mobile offices.

Utah Building Code Permit Place

4106 W Sierra Dr Park City Ut 84098 3 Beds 3 5 Baths Park City Mchenry Great Rooms

Washington County Utah Wikiwand

Duchesne Morgan Uintah County Utah Image Map Png 652x709px Duchesne Area City City Map Image Map

Summit County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Low Income Apartments With No Waiting List Low Income Apartments Low Income Income

12 Facts About Bars And Booze In Utah That Might Surprise Or Confuse You Even If You Don T Drink Alcohol

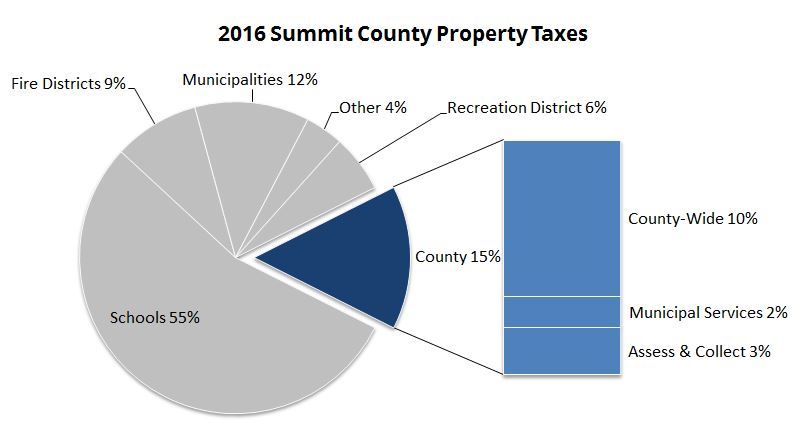

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Corporate Retention Recruitment Business Utah Gov

8066 Red Fox Ct Park City Ut 84098 Zillow Park City Ut Park City Mansions

Zip Code 84123 If You Have Any Questions Please Feel Free To Call Or Email Me Charise Gilbert 801 651 0944 Salt Lake County Feelings

Washington County Utah Wikiwand

Summit County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Do You Make The Cash To Be In Utah S 1 Percent Cash Utah Investing

How Healthy Is Summit County Utah Us News Healthiest Communities

Summit County Utah Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Nevada Becomes 10th State To Ditch Tampon Tax Tampon Tax Tampons Nevada